Tax Collector

Jennifer Muscara, CFO/CTC

Location: 600 Bloomfield Ave, Verona, NJ 07044

Hours: 8:30 AM – 4:30 PM Monday-Friday

Contact:

- Tax (973) 857-4777

- Water/Sewer (973) 857-4798

Have a Question or Comment?

SUBMIT AN ONLINE REQUEST

*A lock box is available 24/7 in the vestibule of the Police Department

VIEW AND PAY YOUR BILL ONLINE

We are happy to announce that automatic direct debit is now available for the payment of Property Taxes and Water/Sewer payments.

Download the AUTOMATIC DEBIT APPLICATION HERE

The Tax Collector’s office processes the billing and collection of all property taxes and Township water/sewer charges.

The Tax Collector’s office acts as the collecting agency for numerous governmental bodies, including the Verona Board of Education and the County of Essex.

Property Taxes

Download this guide to help understand your taxes better

- Tax bills are mailed twice a year. In June for 3rd quarter and September for 4th, 1st & 2nd quarters

- Failure to receive a tax bill does not exempt you from paying taxes or the interest due on delinquent taxes

- Taxes are due quarterly: August 1, November 1, February 1, May 1

- There is a 10-day grace period. If the 10th day falls on a weekend/holiday, the grace period extends to the next business day.

- Please be advised payments must be received in the Tax Office by 4:30pm on or before the last day of the grace period – postmarks are not permitted. Payments made online, must be received by 11:59pm on the last day of the grace period.

- The drop box is checked at 4:30pm on the last day of the grace period. Any payments received after 4:30pm, will be considered paid as of the next business day.

Interest Rate

The Township of Verona has adopted by resolution an interest rate of 8% for the first $1,500 of delinquency, and 18% for any delinquency over $1,500 as allowed per state statute N.J.S.A 54:4-67, as well as a 6% year-end penalty on any balance owing as of December 31 st in excess of $10,000.00.

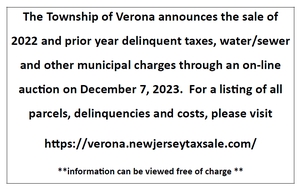

Tax Sale

Any unpaid delinquent taxes due from the prior year which are still owing may be subject to “TAX SALE”. Tax Sale is the enforcement of collections against a property by placing a lien against the property for all outstanding municipal charges due at the end of the Calendar year (December 31). Municipal charges include but are not limited to: Property Taxes, Special Improvement District Taxes (S.I.D), Added/Omitted Assessments, Property Maintenance liens.

Visit Verona's Official Tax Lien Auction Site

State of New Jersey Property Tax Relief Programs :

There are three separate and distinct property tax relief programs available to New Jersey homeowners from the State.

All Property Tax Relief Programs: https://www.state.nj.us/

- Property Tax Reimbursement Program (Senior Freeze)

- Homestead/Anchor Program

- Annual Veteran & Senior/Disabled $250.00 deductions

Annual Property Tax Deduction for Veterans:

Annual deduction of up to $250 from taxes due on the real or personal property of qualified war veterans and their unmarried surviving spouses/surviving civil union partners/surviving domestic partners. ***

Annual Property Tax Deduction for Senior Citizens, Disabled Persons:

Annual deduction of up to $250 from property taxes for homeowners age 65 or older or disabled who meet certain income and residency requirements. ***

***These (2) benefits are administered by the local municipality. Eligibility Requirements, applications, and assistance with these deductions are available at the Finance Office.

Utility Relief Updates

- Visit for a full listing of assistance programs http://nj.gov/dca/dcaid or call: 2-1-1

- Ratepayer Relief Notice

- Winter Termination Program - Electric, Sewer and Water Service relief

- Visit NJ Dep. of Community Affairs for more information

Links

- Pay Your Tax or Utility Bill Online: Includes Tax & Utility Information

- Official Tax Lien Auction Site

- Essex County Board of Taxation